Overview

This section provides an overview of the following topics related to submitting an interim payment request to CMS' RDS Center.

- Introduction to Submitting an Interim Payment Request

- Timing & Dependencies

- User Roles

- Preparing for an Interim Payment Request

- Determining and Rendering Payment

- Understanding Error Conditions

- Mandatory Payment Reduction

Introduction to Submitting an Interim Payment Request

The interim payment process allows Plan Sponsors to receive interim payments for an application throughout the plan year instead of receiving one final payment after completing Reconciliation. A Plan Sponsor often repeats the interim payment process several times throughout the lifecycle of the application.

During the interim payment process, the Payment Requester reviews Benefit Option costs submitted by Cost Reporter(s), builds the payment request by selecting which Benefit Options to include, and submits the payment request to CMS' RDS Center.

An interim payment request may include any updated costs submitted for a Benefit Option. Before the updated Benefit Option costs can be included in the payment request, the Payment Requester must first review all Benefit Option costs. For more information about how Payment Requesters review interim costs submitted for a Benefit Option, refer to Complete Review of Benefit Option Interim Costs.

When at least one Benefit Option is eligible to be included in a payment request, the Payment Requester may build an interim payment request by reviewing the costs, selecting which Benefit Options to include, and submitting the request to CMS' RDS Center. For more information on how to build and submit an interim payment request, refer to Build and Submit an Interim Payment Request.

Plan Sponsors cannot submit a negative payment request or a zero-dollar payment request.

Resources:

- For information about how to prepare costs, refer to Prepare Cost Data.

- For information about how to submit interim cost reports, refer to Submit Interim Costs.

Timing & Dependencies

An interim payment may be requested on an application when the following conditions are met:

- The application is approved.

- Payment Setup is complete.

- New interim costs were submitted for at least one Benefit Option since the last payment request, and the Payment Requester completed the review for the new interim costs.

- At least 16 business days have passed since the last payment approval, or 31 business days have passed since the last payment request; whichever is later.

- To request another interim payment, the Next Payment Request status on the Interim Payment Request page displays "Payment Can Now Be Requested." If a payment request is in progress, the Plan Sponsor cannot request payment.

NOTE: All RDS applications’ Payment Frequency is set to a maximum frequency of monthly interim payments, consistent with the general payment rules regarding timing set forth in 42 C.F.R. 423.888(b)(1). Although 12 interim payment requests are permitted, a Plan Sponsor may choose to submit fewer than 12 interim payment requests, or forego interim payments and instead choose to submit one final payment request during Reconciliation as described in 42 C.F.R. 423.888(b)(2)(ii).

User Roles

Payment Requester

A Payment Requester is an individual that has been granted permission and is assigned to build and submit payment requests using the RDS Secure Website. Payment Requesters can be assigned to an application during the Payment Setup process. The Request Payment privilege is automatically assigned to the Authorized Representative but can also be assigned to the Account Manager or a Designee. An application may have one or more Payment Requesters assigned simultaneously. A Payment Requester views Benefit Option costs through Request Payment in the Left Navigation menu rather than Report Costs (used by Cost Reporters).

Note: The Account Manager and Authorized Representative must maintain active RDS Secure Website user accounts in order for a Plan Sponsor to receive payment. Accounts can be disabled due to inactivity or deactivated due to an invalid email address. If a user account becomes inactive or disabled while payment is in progress, the payment will be halted. As such, it is important for the Account Manager and Authorized Representative to verify their email address prior to payment.

Authorized Representative

Since the Authorized Representative is the only individual who may submit the annual payment request or Reconciliation payment request, they are automatically granted the Request Payment privilege during Payment Setup. The Authorized Representative always has the ability to review cost reports, build and submit payment requests, and view payment request statuses and payment history. Therefore, the Authorized Representative cannot report costs.

Account Manager with Request Payment Privilege

During Payment Setup, the Account Manager must be assigned one of three privileges: Request Payment privilege, Report Costs privilege, or View Only privilege. The Account Manager may not have both the Report Costs privilege and the Request Payment privilege on the same application. A Payment Requester cannot report costs, and a Cost Reporter cannot request payments.

An Account Manager with the Request Payment privilege is able to review cost reports, build and submit payment requests, and view payment request statuses and payment history. If the Account Manager is assigned the Report Costs privilege or View Only privilege, they are only able to view payment data, such as the status of current Benefit Option costs and payment requests.

Designee with Request Payment Privilege

The Designee can be assigned the Request Payment privilege or the Report Costs privilege in Payment Setup, but not both for the same application. Designees with the Request Payment privilege are able to review cost reports, build and submit payment requests, and view payment request statuses and payment history. Designees assigned the Report Costs privilege do not have payment request access for the application.

Preparing for an Interim Payment Request

During the Interim Payment process, the Payment Requester reviews Benefit Option costs submitted by Cost Reporter(s), builds the payment request by selecting which Benefit Options to include, and submits the payment request to CMS' RDS Center.

An interim payment request may include any updated Benefit Option costs that have been submitted for a Benefit Option by a Cost Reporter. Only submitted cost reports can be reviewed by a Payment Requester, and only reviewed Benefit Option costs can be included in an interim payment request.

Note: A cost report is not considered to be submitted or in "Submitted" status if it is only saved through Data Entry method or is submitted with errors through the Connect:Direct method.

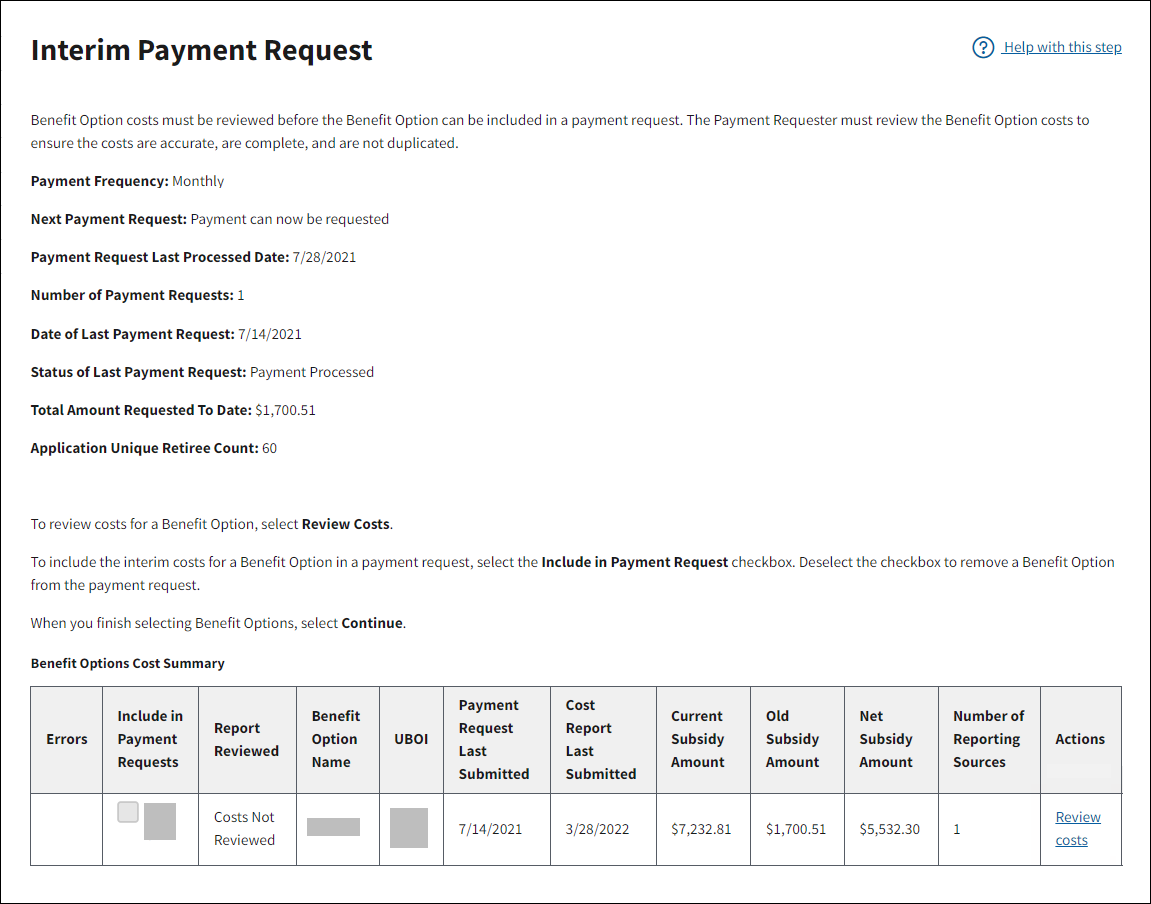

Interim Payment Request Page

Authorized Representatives, Account Managers, and Designees with the Request Payment privilege may review Benefit Option costs or build a payment request using the Interim Payment Request page on the RDS Secure Website.

The Benefit Options Cost Summary table displays interim costs reported for each Benefit Option in the application. From this table you can review the Benefit Option costs, view the Report Reviewed status for each of the Benefit Option costs, and select a Benefit Option to include in a payment request.

The following payment and cost reporting information for each Benefit Option is available on this page:

- Errors – Displays an exclamation point icon when a Benefit Option Level error has been detected for the Benefit Option.

- Include in Payment Request – Checkbox controls the action to include the interim costs for a Benefit Option in a payment request.

- Report Reviewed – Displays a status of "Costs Reviewed", "Costs Not Reviewed", or "No New Costs to Review" for the Payment Requester to review the most recently submitted Benefit Option costs.

- Benefit Option Name

- Unique Benefit Option Identifier (UBOI)

- Payment Request Last Submitted – Displays a status of "No Request" or the date the Benefit Option was last included in a payment request.

- Cost Report Last Submitted – Displays a status of "No Reports" or the date of the last submitted cost report.

- Current Subsidy Amount – Displays the calculated subsidy amount derived from the most recent interim cost reports submitted for the Benefit Option.

- Old Subsidy Amount – Displays the calculated subsidy amount derived from the interim costs reported for the Benefit Option that were last included in a payment request that was not cancelled.

- Net Subsidy Amount – Displays the calculated difference between the Current Subsidy Amount and the Old Subsidy Amount. The Net Subsidy Amount for the Benefit Option is the amount of subsidy eligible to be included in a payment request. The amount of the payment request equals the sum of the Net Subsidy amounts for all Benefit Options included in the payment request.

- Number of Reporting Sources – Displays the number of Cost Reporting Sources (Plan Sponsor and/or Vendors) eligible to report costs for the Benefit Option.

- Actions

Reviewing Interim Costs by Benefit Option

Benefit Option costs must be reviewed before the Benefit Option can be included in a payment request. The Payment Requester must review the Benefit Option costs to ensure the costs are accurate, are complete, and are not duplicated. The Payment Requester may only view costs that are submitted by Data Entry and/or by Connect:Direct transmission. Data Entry costs saved on the RDS Secure Website cannot be viewed by a Payment Requester until submitted by the Cost Reporter. Connect:Direct costs with detected errors cannot be viewed by the Payment Requester. When the Benefit Option has a status of "Costs Reviewed" and there are no errors detected at the Benefit Option level, it is eligible to be included in an interim payment request.

If errors are detected on submitted costs, the Payment Requester cannot change cost data. Only Cost Reporters may change or submit cost data. Errors are typically due to a change in Qualifying Covered Retiree (QCR) information since costs were last submitted for the Benefit Option. It is possible that the maximum Allowable Retiree Costs or maximum Threshold Reduction amount reported exceeds the QCR information associated with the Benefit Option. The Payment Requester must coordinate with the Cost Reporter(s) to determine if costs or QCR information must be updated for the Benefit Option.

Note: A Cost Reporter may continue to transfer Connect:Direct files or report interim costs using the RDS Secure Website regardless of whether previously reported costs have been included in a payment request. All submitted costs are maintained and can be included in the next payment request.

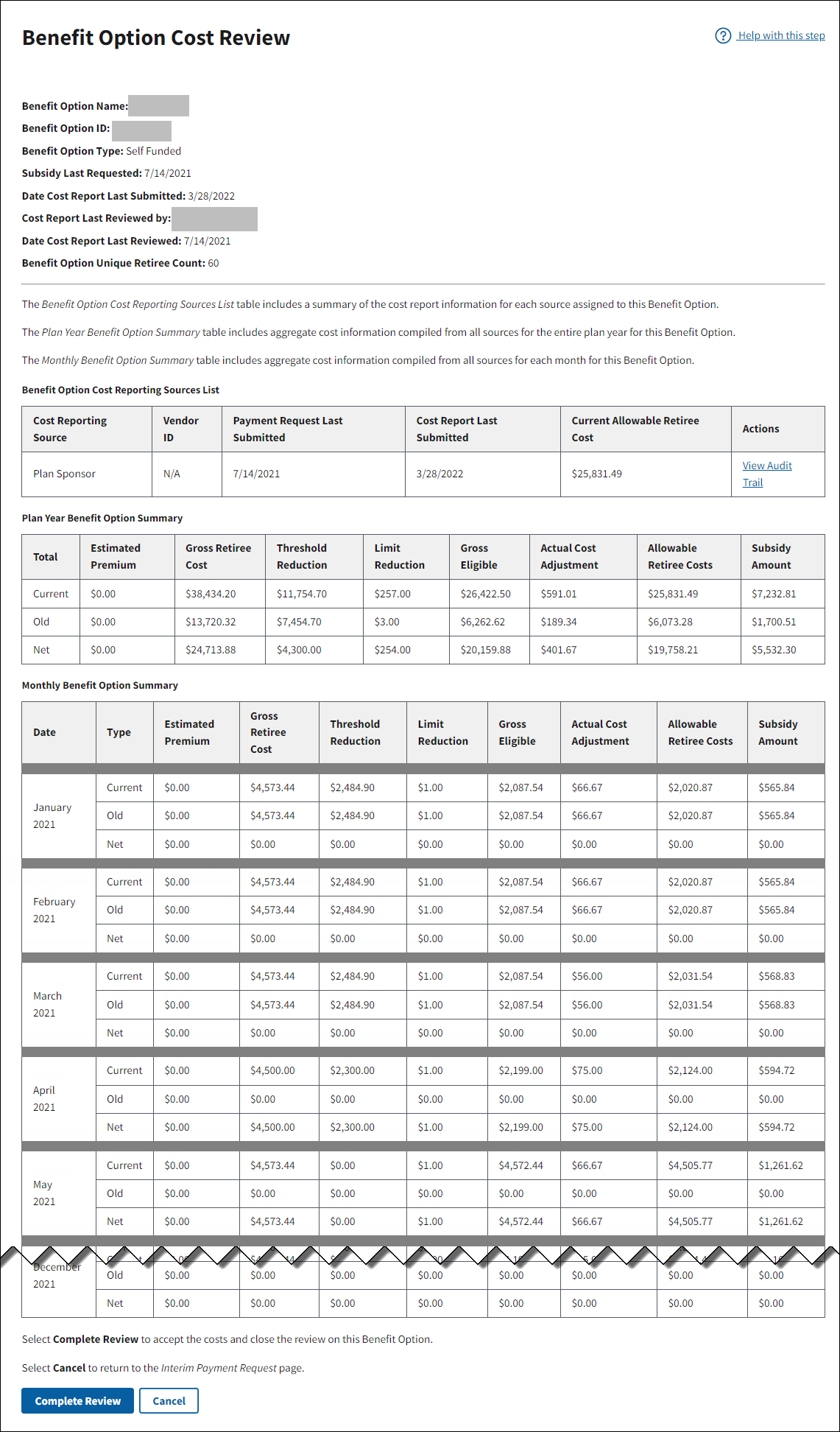

Benefit Option Costs Review Page

All reported costs and the calculated subsidy for the Benefit Option are displayed on the Benefit Option Costs Review page for the Payment Requester to review. Benefit Option costs may be reviewed by plan month and at the Cost Reporting Source level. The page displays the following detail information for the Benefit Option:

- Benefit Option Name

- Benefit Option ID

- Benefit Option Type

- Subsidy Last Requested Date

- Cost Report Last Submitted Date

- Cost Report Last Reviewed By

- Date Cost Report Last Reviewed

- Benefit Option Unique Retiree Count

The page displays two tables:

- The Plan Year Benefit Options Summary table displays the Current, Old, and Net interim cost data for the selected Benefit Option for the entire plan year.

- The Monthly Benefit Option Summary table displays the Current, Old, and Net interim cost data for the selected Benefit Option by plan month.

Notes:

- Current costs reflect the most recently submitted costs for the Benefit Option.

- Old costs reflect the submitted costs last included in a payment request.

- Net costs are calculated as the difference between "Current" and "Old" costs. The Net Subsidy Amount is the amount eligible for payment when the Benefit Option is included in a payment request.

- The Complete Review button does not display for Account Managers with View Only or Report Costs privilege.

Building and Submitting an Interim Payment Request

When at least one Benefit Option is eligible to be included in a payment request, the Payment Requester may build an interim payment request by selecting which Benefit Options to include on the Interim Payment Request page. The Benefit Option costs include the system-calculated subsidy amounts based on the submitted cost data. The Plan Sponsor may decide to include all or a portion of the eligible Benefit Options in the interim payment request. A Benefit Option is eligible to be included in a payment request when the following conditions are met:

- New interim costs were submitted for the Benefit Option since the last payment request;

- The Benefit Option has a "Costs Reviewed" status in the Benefit Options Cost Summary table; and

- No system errors have been detected for the submitted Benefit Option costs.

Note: Benefit Option costs must be reviewed by the Payment Requester to be eligible to be included in a payment request. For more information, refer to Complete Review of Benefit Option Interim Costs.

As the Payment Requester proceeds with the payment request, the RDS Secure Website examines the costs for the entire application and for each Benefit Option included in the payment request. If errors are detected, the Payment Requester cannot proceed with the payment request. Only Cost Reporter(s) may change or update costs. The Payment Requester must contact the Cost Reporter(s) to address the detected errors and resubmit costs. To proceed with the interim payment request, the Payment Requester may return to the Interim Payment Request page and exclude any Benefit Option(s) with errors from the request.

For more information on correcting cost reporting errors, refer to Error Conditions.

If no errors are detected, the payment request is authorized and submitted to CMS’ RDS Center. After submitting the interim payment request, the Interim Payment Request page displays the total amount of the subsidy request, the current date, and the breakdown of Benefit Options included in the payment request.

Requested payments are usually processed within 30 calendar days from the date the request is submitted. An email is sent to notify the Plan Sponsor after a payment has been approved. The email is sent to the Account Manager and the Authorized Representative is copied.

Determining and Rendering Payment

After a payment request is made, CMS' RDS Center validates the payment request, makes payment adjustments to the request, if necessary, sends the subsidy payment using Electronic Funds Transfer (EFT), and notifies the Plan Sponsor of the payment status. This process can take up to 30 calendar days. If more than 30 calendar days have passed, contact CMS’ RDS Center for additional information.

Payment Request Statuses

The payment request status displays on the Interim Payment Request page in the Status of Last Request field. The following statuses apply to a payment request:

- Payment Requested - A request was submitted on the RDS Secure Website and the payment is in progress.

- Payment Processed - CMS' RDS Center finalized the payment request. The Plan Sponsor receives an email providing details about CMS' RDS Center’s payment approval.

-

Payment Pending due to EFT failure - The ACH-EFT payment transaction was rejected by the Plan Sponsor's bank. This indicates that the Banking Information (Organization Name, Account Number, Bank Routing Number, and Account Type) provided to CMS' RDS Center on the application is invalid. The Plan Sponsor receives an email informing them that a Banking Information change is required. If the Plan Sponsor is unclear why the supplied Banking Information is rejected, it should confer with the financial institution provided in the application.

After a successful pre-note is obtained, CMS' RDS Center attempts to process the ACH-EFT payment transaction again. For more information about updating Banking Information on a submitted application, refer to Manage Banking Information. For more information about the circumstances under which a payment request may be placed on hold and/or cancelled and how to resolve issues before cancellation, refer to Payment Requests Placed on Hold.

- Payment Request Cancelled/Rejected - CMS' RDS Center cancelled the payment request. For more information about the circumstances under which a payment request may be placed on hold and/or cancelled and how to resolve issues before cancelation, refer to Payment Requests Placed on Hold.

- Payment Rejected due to Debarment - CMS' RDS Center cancelled the payment request because the Plan Sponsor and/or any of the individuals associated with the application (Authorized Representative, Account Manager, Actuary, and/or Designees) were found on the U.S. General Services Administration (GSA) Debarment List or the Office of Inspector General (OIG) Exclusion List. Such organizations and individuals are prohibited from doing business with the federal government and cannot request subsidy.

Note: For more information on payment history events, including payment request statuses and other payment activities, refer to Access Payment History.

Payment Validation

Pursuant to 42 C.F.R. 423.888, there are multiple scenarios during the Payment Validation process that can delay or stop a payment request from being processed. Furthermore, payments that remain on hold for 60 days and are not resolved by the Plan Sponsor are subject to cancellation by the RDS Center. Conditions that delay or stop payment include:

- Account Managers and Authorized Representatives with inactive or pending RDS Secure Website accounts delay or stop payment. The most common reason for a user to become inactive is due to an invalid email address. CMS' RDS Center periodically sends email notices. If an email repeatedly bounces back, the account can become flagged as inactive. As such, it is critical that all system users keep their contact information up to date.

- Account Managers and Authorized Representatives with invalid user account statuses delay or stop payment. The Account Manager and Authorized Representative roles must be in an Active status for the Plan Sponsor to receive payment. Payment requests will not be processed until the user’s status is updated to Active in the Secure Website.

- Submitting an interim payment request 60 days from the Reconciliation Deadline delays or stops payment. Interim payment requests submitted after initiating Reconciliation will be cancelled.

For more information, refer to Payment Requests Placed on Hold.

Payment Adjustments

Payment adjustments on positive payment requests are made to offset negative payment requests. A negative payment request occurs when the Plan Sponsor has a negative balance. If the Plan Sponsor has a negative balance or overpayment on an application, CMS' RDS Center automatically deducts the negative amount from any positive interim payment requests or any positive final payment requests for the same Plan Sponsor. The Plan Sponsor does not have to actively request that positive payments be applied to an existing negative balance or overpayment.

If after any payment adjustments the payment determination amount is still positive (meaning it is greater than zero), then the interim subsidy payment is rendered. Most payment requests are processed within 30 calendar days from the date of submission of the request. Payments are sent using Electronic Funds Transfer (EFT).

Notes:

- For more information on payment history events, including payment adjustments and other payment activities, refer to Access Payment History

- For more information on overpayments, refer to Satisfy an Overpayment.

Banking Information Failure

Banking Information must be maintained on the application for CMS' RDS Center to send subsidy payments to the Plan Sponsor's bank. The Plan Sponsor may change Banking Information at their discretion, or after CMS' RDS Center sends an email notification of payment or pre-note failure due to invalid or missing banking information.

CMS' RDS Center validates certain information including Organization Name, Account Type, Account Number, and Bank Routing Number. If CMS' RDS Center could not process a payment request, the application status is marked "Application Error," and the Banking Information section of the application is marked "Error-Needs Attention." The Plan Sponsor is notified by email, and the subsidy payment is held.

If the Plan Sponsor is unclear why the Banking Information was invalid, it should contact the financial institution listed on the application.

For more information on changing Banking Information on an application, refer to Manage Banking Information. For more information about the circumstances under which a payment request may be placed on hold and/or cancelled and how to resolve issues before cancellation, refer to Payment Requests Placed on Hold. Once a successful pre-note is obtained, CMS' RDS Center again attempts the subsidy payment.

Note: For more information on payment history, including the status of Banking Information as part of payment processing, refer to Access Payment History.

Understanding Error Conditions

The Payment Requester may come upon system errors when completing review of Benefit Option costs, or when building a payment request during the payment verification stage. The RDS Secure Website prevents the Payment Requester from proceeding with the payment request if system errors are detected.

The RDS Secure Website applies cost edits to the total costs accepted for the application by examining costs and Qualifying Covered Retirees (QCRs) for the entire application and each Benefit Option included in the payment request. These edits assure that the maximum Allowable Retiree Cost and Threshold Reduction have not been exceeded per individual QCR as a result of insufficient coordination of individual retiree costs, or a reduction in retirees since costs were last reported.

Note: The Plan Sponsor may choose to proceed with the interim payment request by excluding Benefit Options with detected errors.

Application Level Errors

For each error detected in the combined application costs, a detailed error message appears at the top of the Interim Payment Request page. The Submit button is disabled. The Plan Sponsor may view the accepted costs for each Benefit Option in detail by selecting View Costs in the Benefit Options Included in Payment Request table.

Benefit Option Level Errors

When the Payment Requester reviews Benefit Option costs, any system errors detected are displayed at the top of the Benefit Option Costs Review page. An error message displays for each error detected in Benefit Option costs. The RDS Secure Website prevents the Payment Requester from completing review of the Benefit Option costs if errors are detected. The Complete Review button is disabled.

Should one or more errors be detected in Benefit Option costs during payment verification, an error message appears in red at the top of the Interim Payment Request page and an exclamation point icon appears in the Errors column of the Benefit Options Included in Payment Request table for the appropriate Benefit Options. The Submit button is disabled. The Plan Sponsor must select View Costs to view detailed error messages on the Benefit Option Costs Review page.

Resolving Error Conditions

Errors may be due to a change in Qualifying Covered Retiree (QCR) information since costs were last submitted. It is possible the maximum Allowable Retiree Costs, or maximum Threshold Reduction amount reported exceeded the QCR information associated with the Benefit Option or application. Also, errors may be due to insufficient coordination of individual retiree costs between Cost Reporting Sources or across Benefit Options. Plan Sponsors cannot submit a negative payment request or a zero-dollar payment request.

Only Cost Reporter(s) may change or update costs. The Payment Requester must coordinate with the Cost Reporter(s) to determine if costs must be updated based on new QCR information, or the Covered Retiree List (CRL) must be updated with current coverage information.

Mandatory Payment Reduction

The Centers for Medicare and Medicaid Services (CMS’) Retiree Drug Subsidy (RDS) Program is subject to the mandatory reductions in Federal spending in accordance with the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA), as amended.

CMS' RDS Center will apply a mandatory payment reduction to all plan months of April 2013 and beyond when calculating payment requests for affected applications.

Beginning with costs incurred in January 2024, CMS’ RDS Center will apply the mandatory payment reduction to each interim payment request and the Reconciliation final payment request.

For additional information on the RDS Mandatory Payment Reduction (i.e., sequestration) policy, refer to Mandatory Payment Reduction.

Step-by-Step Instructions

This section provides step-by-step instructions to complete the following tasks for submitting an interim payment request:

Complete Review of Benefit Option Interim Costs

Note: The Payment Requester is required to complete the cost review process before the Benefit Option can be included in a payment request. For more information on building and submitting a payment request, refer to Build and Submit an Interim Payment Request.

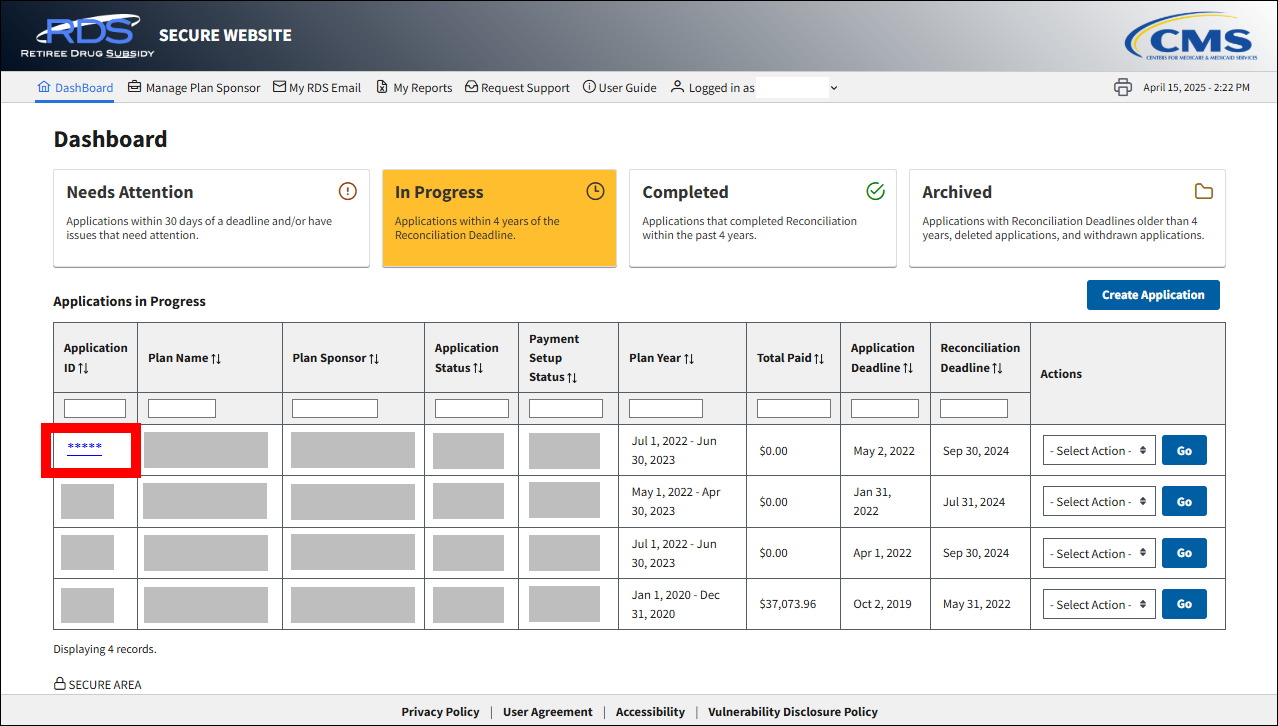

To access the RDS Secure Website and navigate to the Dashboard page, review instructions to access the RDS Secure Website.

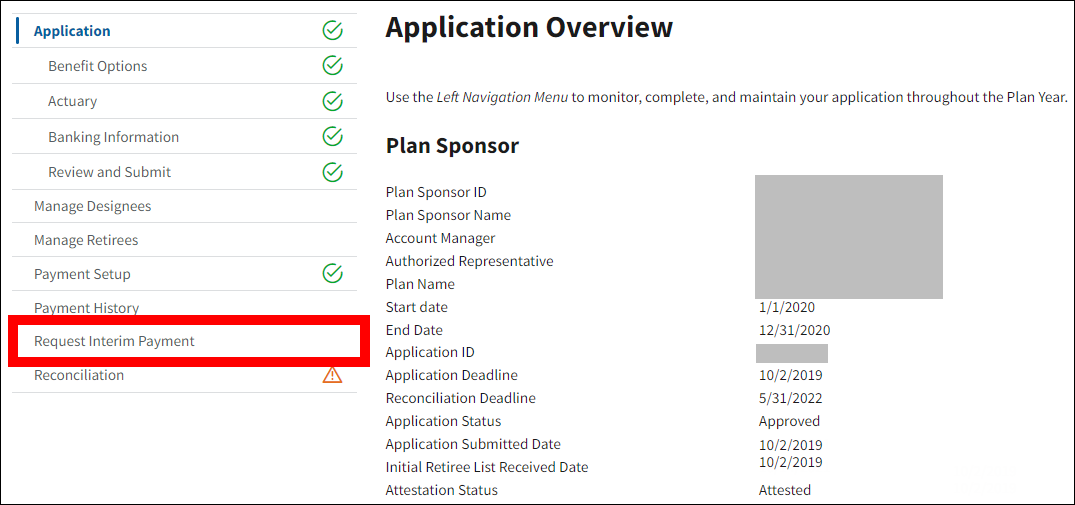

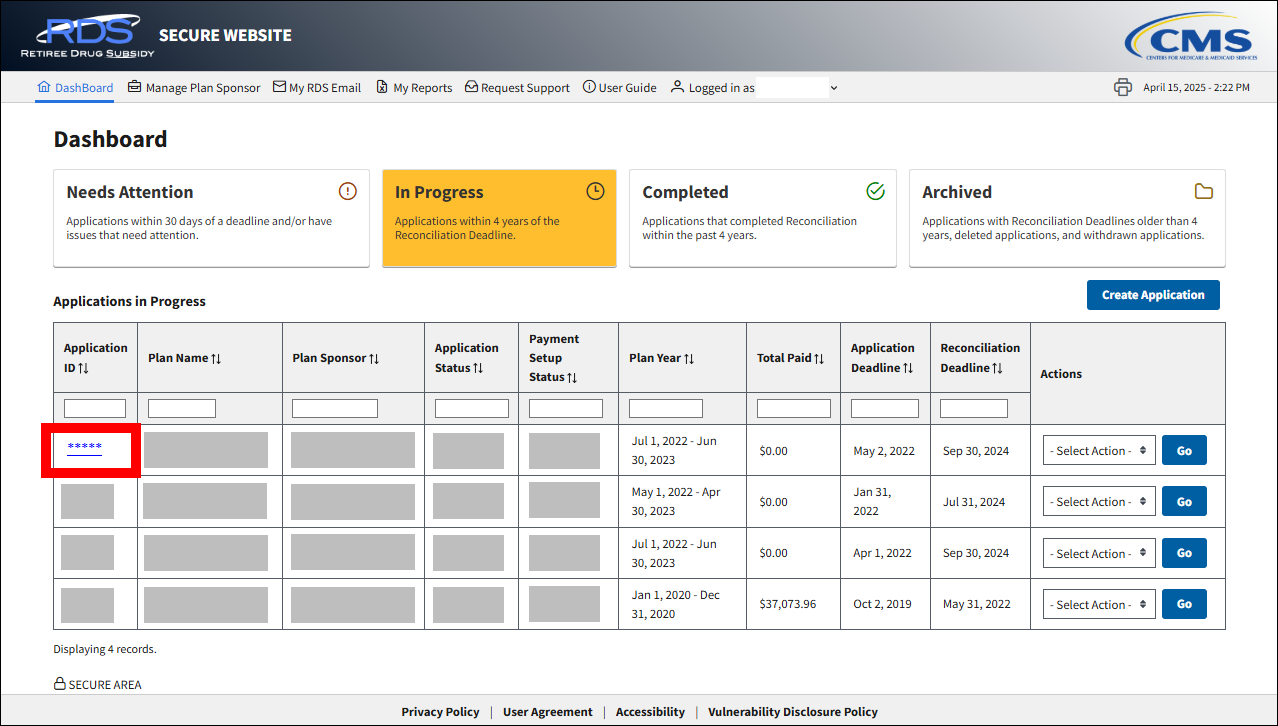

On the Dashboard page:

- Select In Progress to view a list of all Applications in progress.

-

Select the Application ID for which you want to request interim payment.

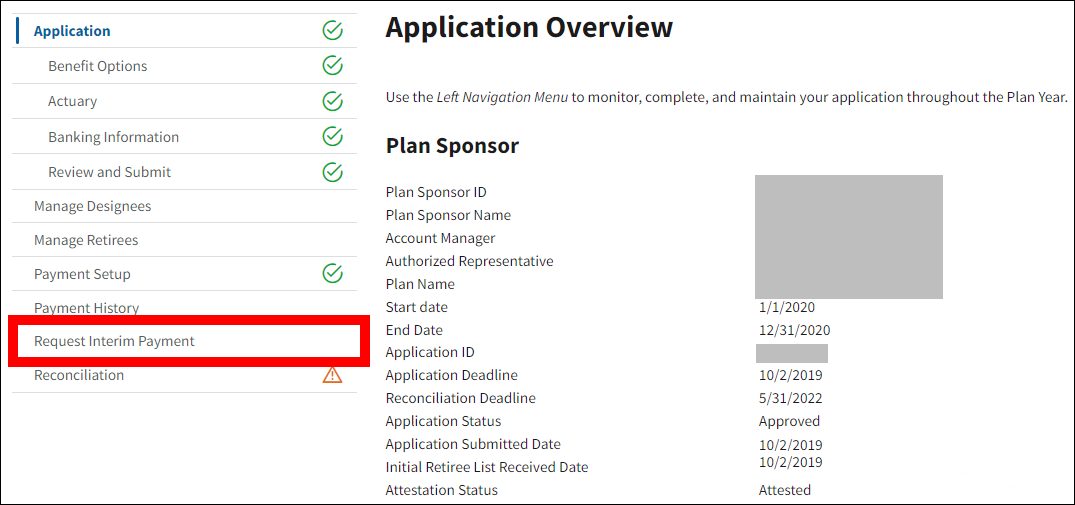

On the Application Overview page:

-

Select Request Interim Payment.

Notes:

- Request Interim Payment only displays in the Left Navigation menu for Authorized Representatives, Account Managers, and Designees assigned the Request Payment privilege. Cost Reporter Designees do not have access.

- Request Interim Payment does not display unless the application status is "Approved" and Payment Setup is complete.

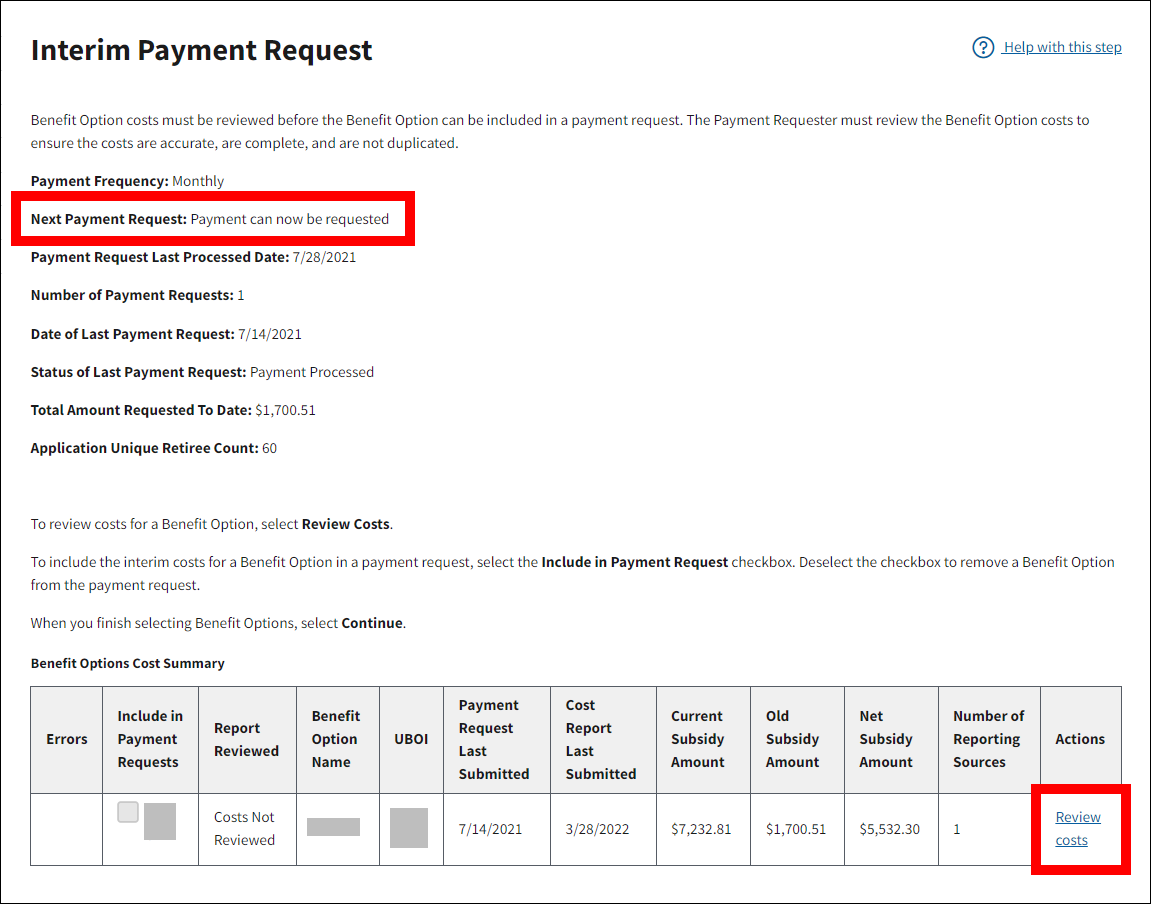

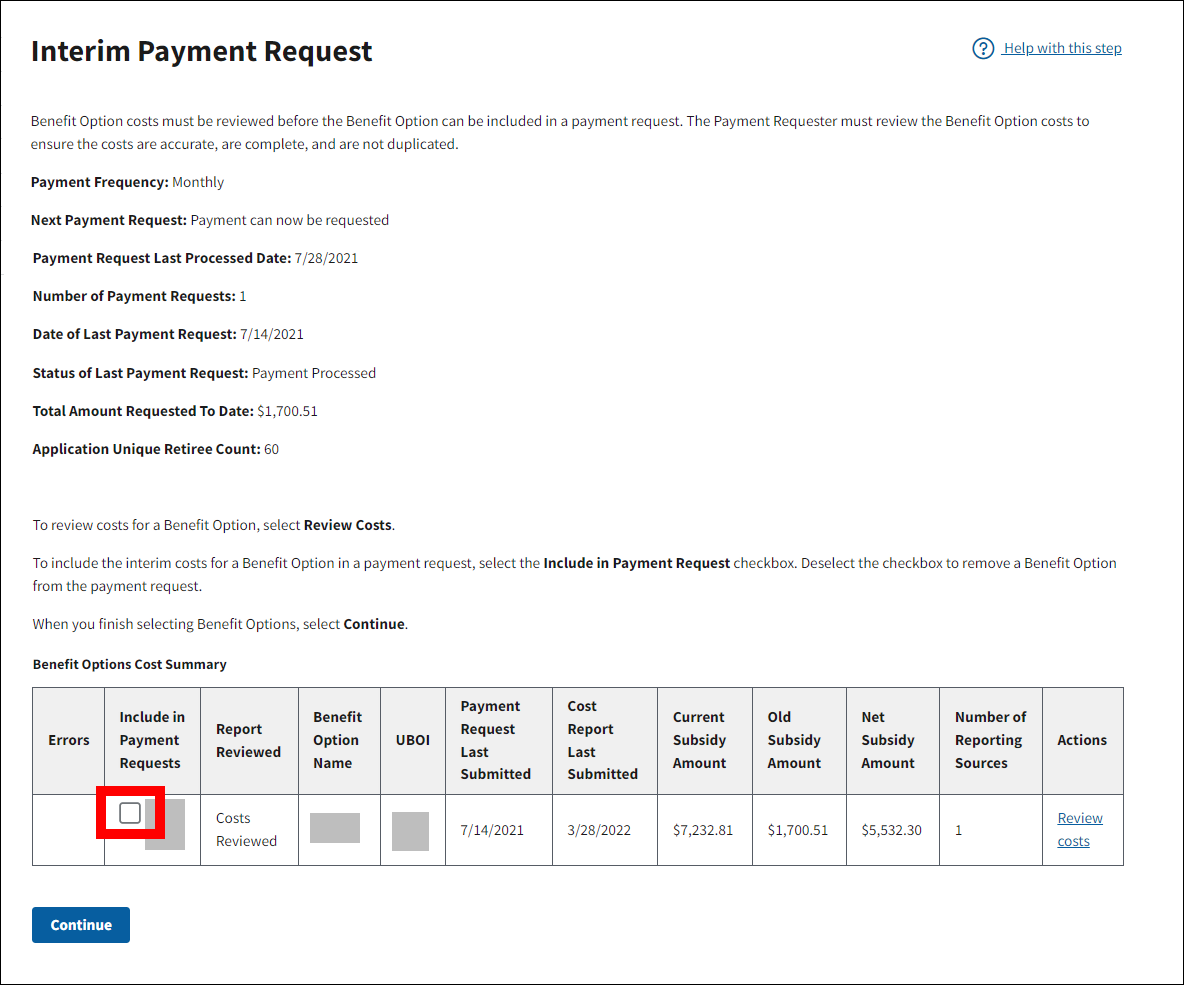

On the Interim Payment Request page:

If the conditions for submitting an interim payment have been met, “Next Payment Request: Payment can now be requested” displays on the page.

- Find the Benefit Option in the Benefit Options Cost Summary table for which costs may be reviewed.

-

Select Review Costs.

Note: The Review Costs action only displays when interim costs have been submitted for the Benefit Option.

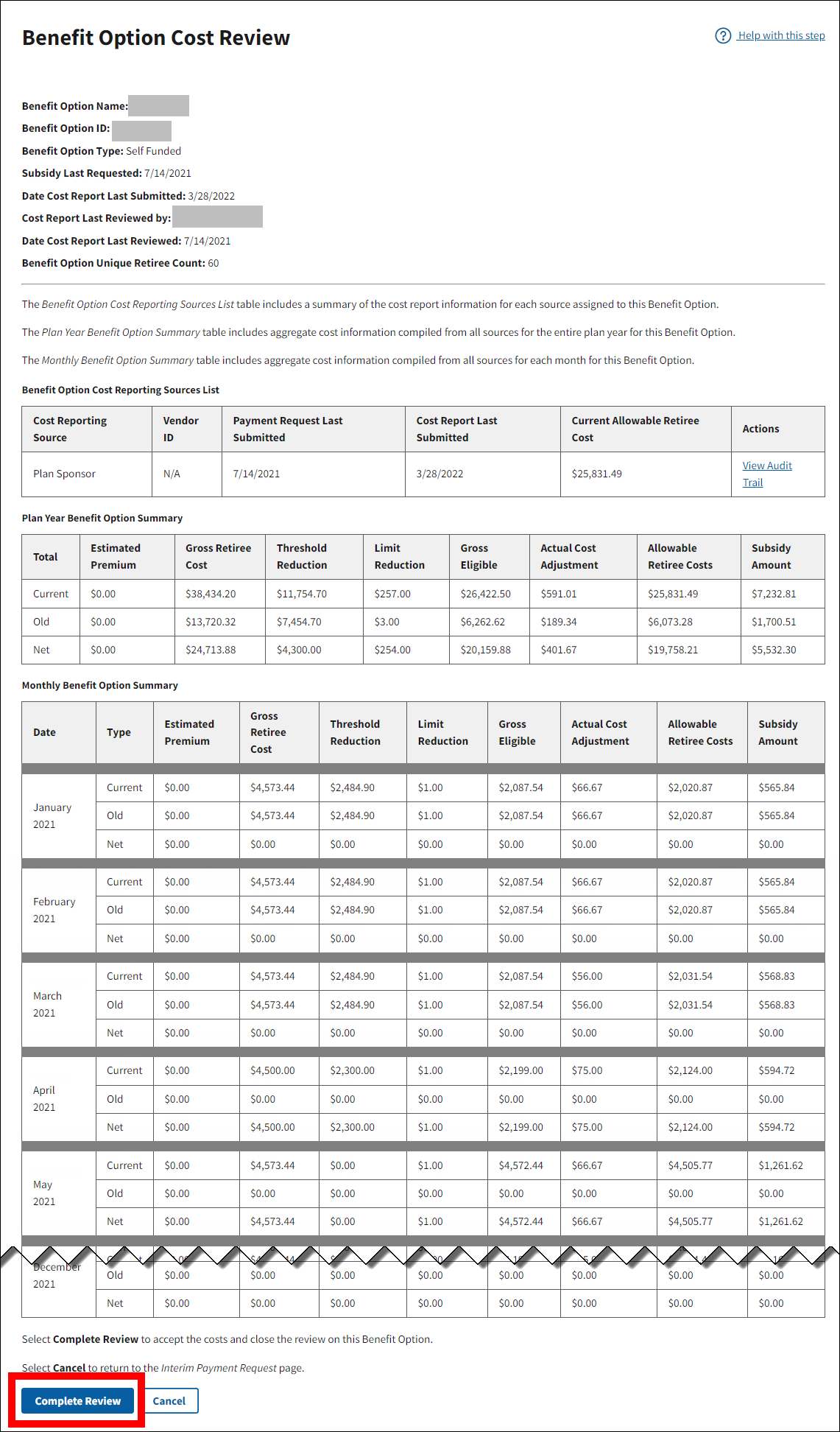

On the Benefit Option Cost Review page:

- Review the Benefit Option Costs for accuracy. Cost details display in the Plan Year Benefit Option Summary table and the Monthly Benefit Option Summary table.

-

Select Complete Review to complete your review or select Cancel to return to the Interim Payment Request page without completing the Benefit Option Costs review.

Notes:

- After you have completed the review of a Benefit Option by selecting Complete Review, you may review the costs again at any time. However, Complete Review will no longer display on the Benefit Option Cost Review page.

- Complete Review does not display on the Benefit Option Cost Review page for Account Managers with View Only or Report Costs privilege.

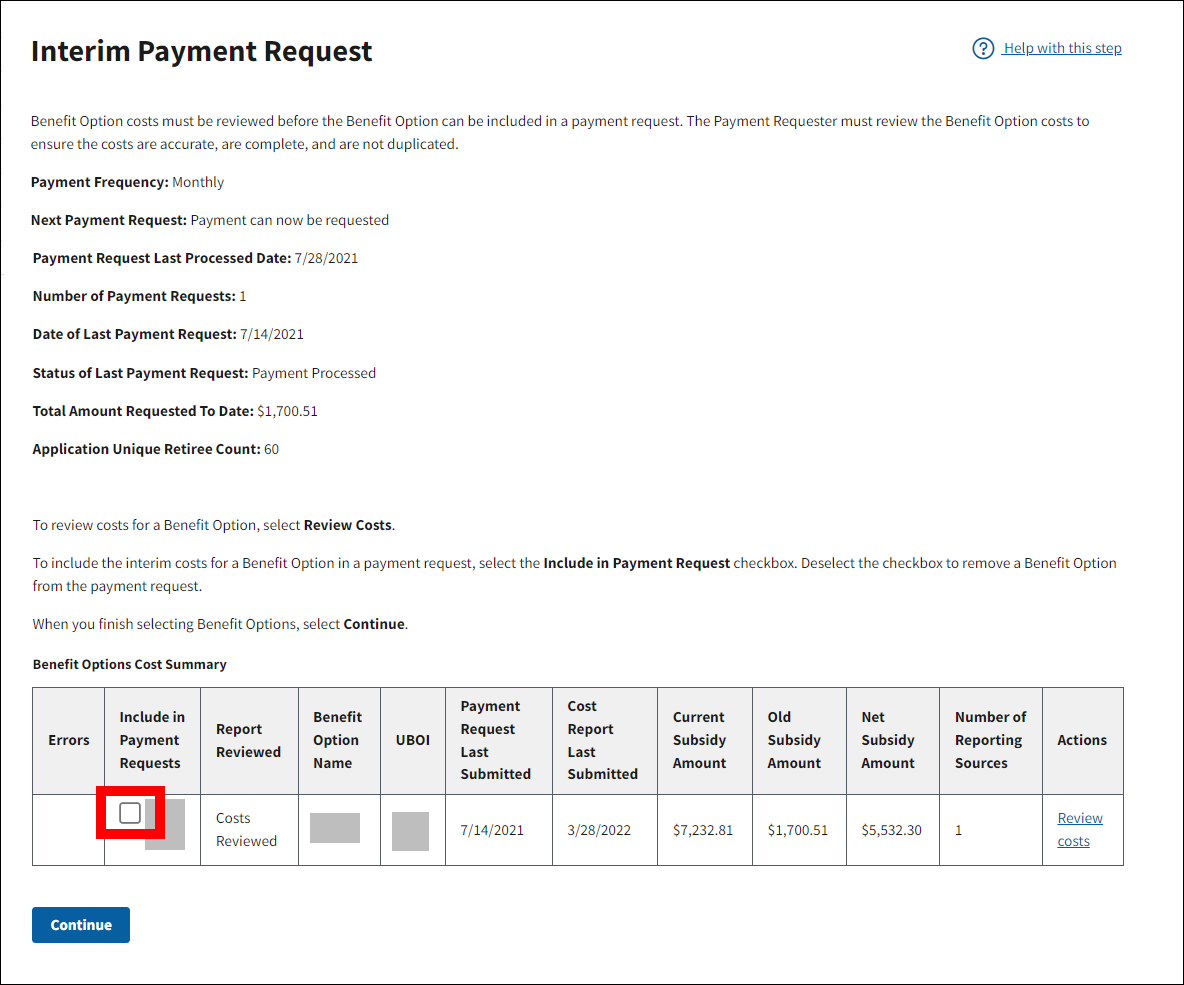

On the Interim Payment Request page:

- The Benefit Options Cost Summary table refreshes. In the row for each Benefit Option for which costs were reviewed, the Include in Payment Requests checkbox is enabled and the Report Reviewed column displays “Costs Reviewed.”

Build and Submit an Interim Payment Request

Note: To be eligible to be included in a payment request, Benefit Option interim costs must be reviewed and have a Review Status of "Costs Reviewed."

To access the RDS Secure Website and navigate to the Dashboard page, review instructions to access the RDS Secure Website.

On the Dashboard page:

- Select In Progress to view a list of all Applications in progress.

-

Select the Application ID for which you want to request interim payment.

On the Application Overview page:

-

Select Request Interim Payment.

Notes:

- Request Interim Payment only displays in the Left Navigation menu for Authorized Representatives, Account Managers, and Designees assigned the Request Payment privilege. Cost Reporter Designees do not have access.

- Request Interim Payment does not display unless the application status is "Approved" and Payment Setup is complete.

On the Interim Payment Request page:

If the conditions for submitting an interim payment have been met, “Next Payment Request: Payment can now be requested” displays on the page.

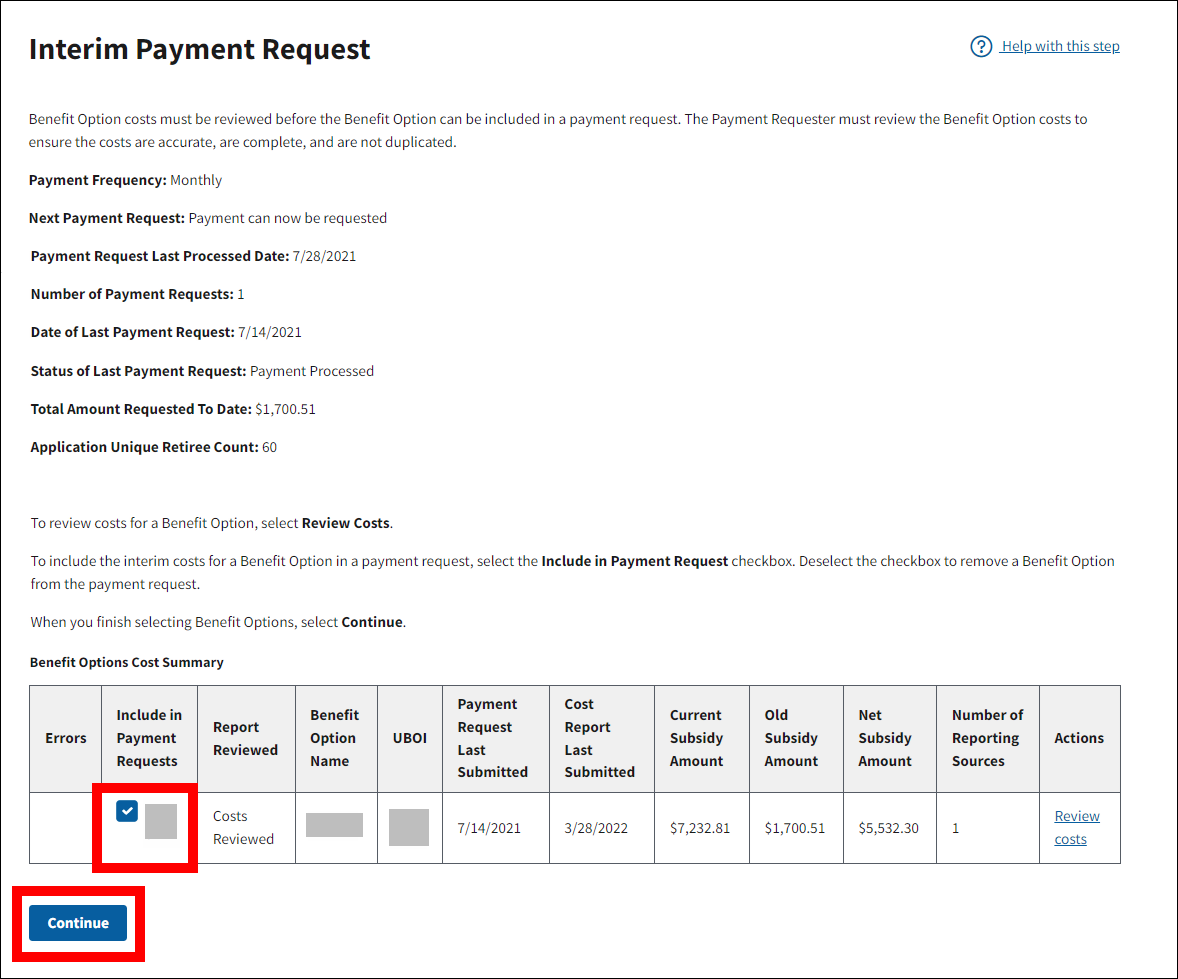

-

To include the interim costs for a Benefit Option in a payment request, select the Include in Payment Request checkbox.

Note: The Include in Payment Request checkbox becomes enabled if the application is eligible for payment, interim costs were submitted since payment was last requested, and the Review Status is "Costs Reviewed" for the Benefit Option.

-

Select Continue.

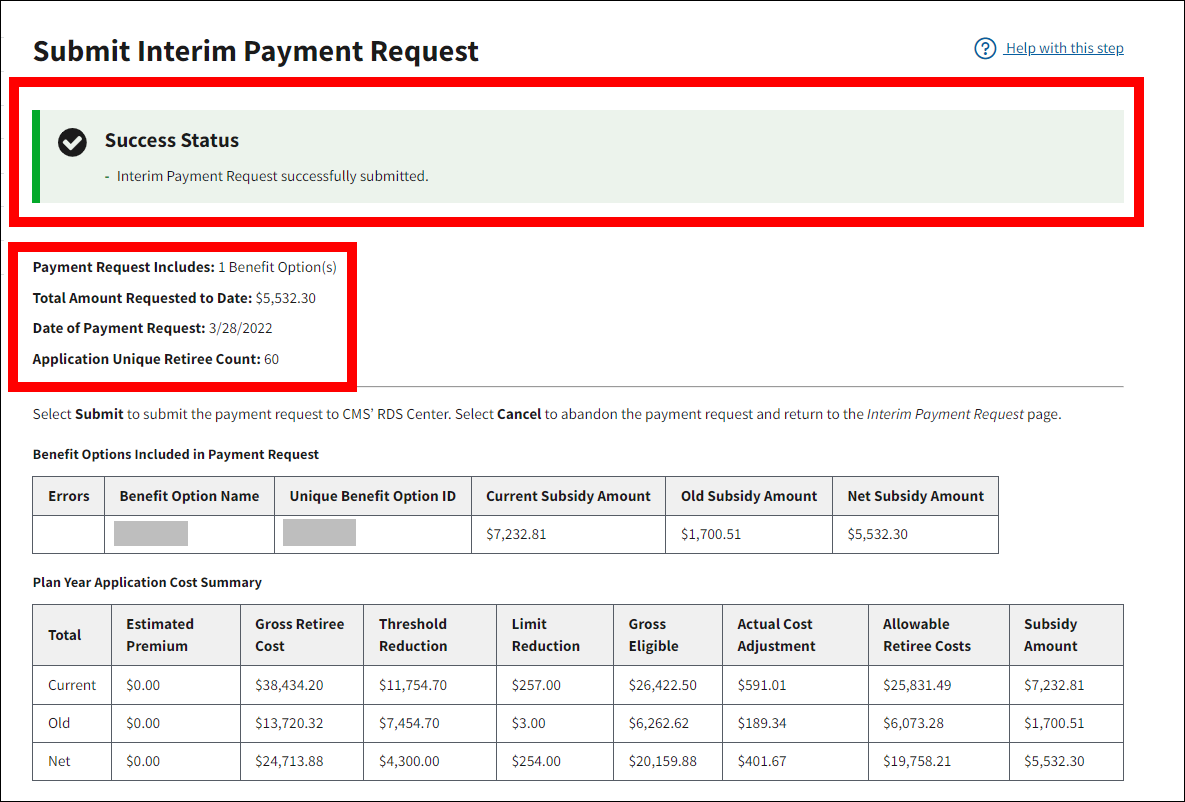

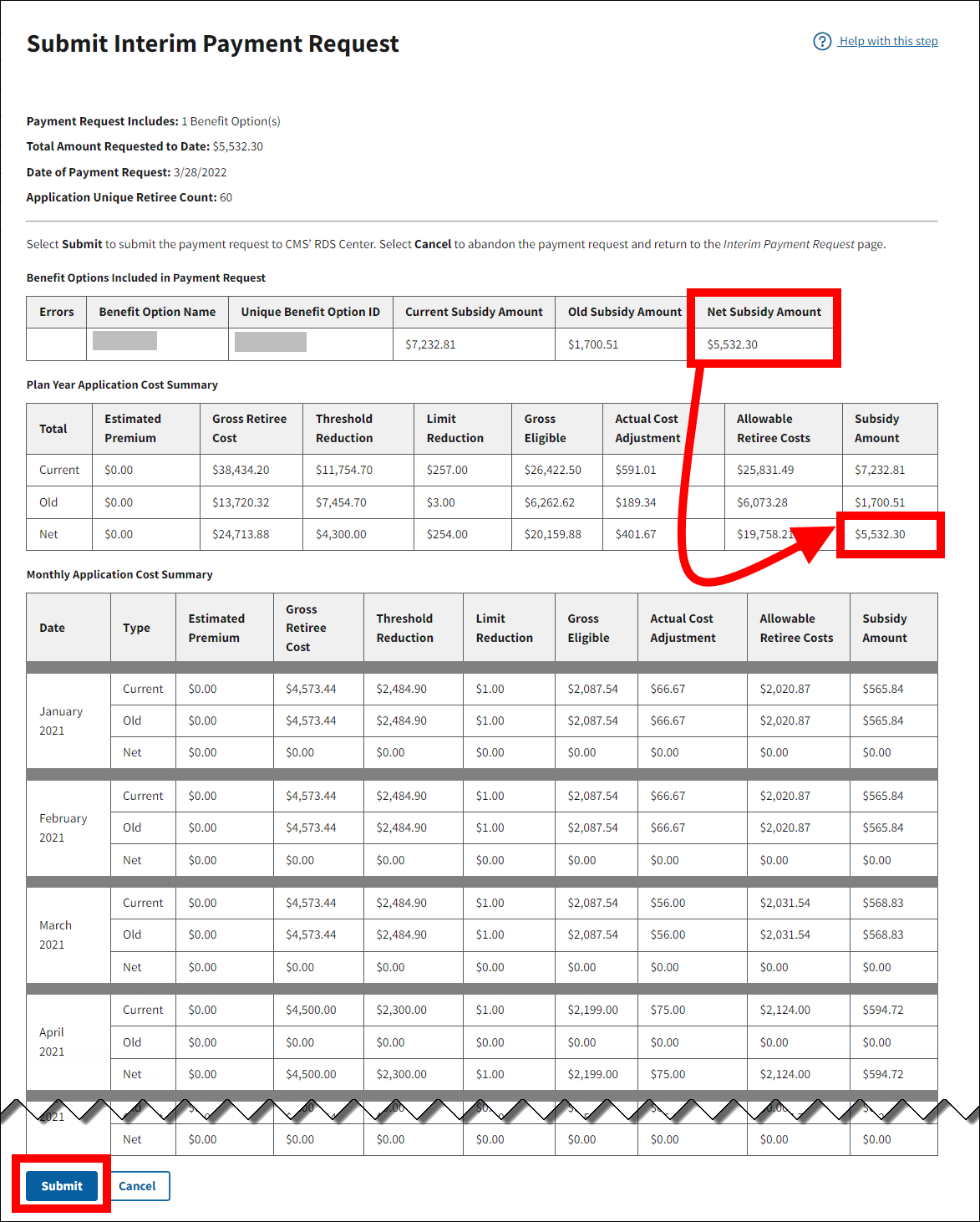

On the Submit Interim Payment Request page:

-

Review the Total Amount Requested to Date and the Net Subsidy Amount.

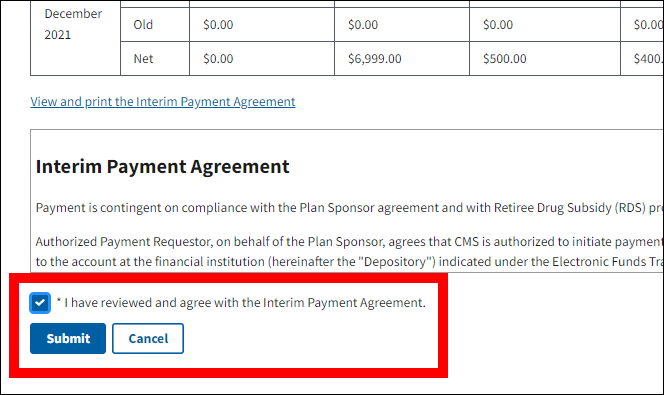

- Select the ‘I have reviewed and agree with the Interim Payment Agreement.’ checkbox.

-

Select Submit to submit the payment request to CMS’ RDS Center. Select Cancel to abandon the payment request and return to the Interim Payment Request page.

When submitting the payment request, allow the RDS Secure Website several minutes to provide confirmation that the request has been submitted. If a user does not wait for confirmation and submits a second payment request while a prior request is processing, the RDS Secure Website will display an error. The RDS Secure Website can only process one payment request at a time for an application.

-

The page refreshes to display a Success message that the Interim Payment Request successfully submitted. The page displays the number of Benefit Options include in the payment request, the total amount of the payment request, the payment request date (i.e., today’s date), and the application’s Unique Retiree Count.

Note: Allow up to 30 days for the payment request to be processed. The Account Manager and Authorized Representative listed on the application are notified by email when the payment is finalized.