This section explains what application information must be maintained after an application has been submitted and approved, how information should be maintained, and what application information cannot be changed.

- User Roles

- Information That Must Be Maintained

- Information That Cannot Be Changed

- Notifying the Plan Sponsor When Changes Occur

- Manage Retirees Through the Application Lifecycle

- Manage Banking Information

User Roles

Application information is maintained by the Account Manager, Authorized Representative, or a Designee granted the appropriate privilege. Retiree data may also be supplied by a Vendor contracted by the Plan Sponsor, or a Coordination of Benefits (COB) contractor. Refer to RDS Secure Website User Roles and Other Program Stakeholders and Introduction to RDS Secure Website User Roles for additional information.

Information That Must Be Maintained

Certain application information must be kept current throughout the Application Lifecycle, while some information may be modified at the Plan Sponsor's discretion.

Information regarding Qualifying Covered Retirees (QCRs) is critical to determining accurate subsidy payment, and must be maintained by both the Plan Sponsor and CMS' RDS Center on a regular basis.

Verifiable Banking Information must be maintained on the application for CMS' RDS Center to render subsidy payments to the Plan Sponsor. If the Banking Information provided on the application fails to be verified by the Plan Sponsor's bank, the Plan Sponsor must correct the Banking Information and re-submit the application. Refer to Application Submission: Banking Information for additional information.

The role of Account Manager and Authorized Representative must always be active, with a current valid user assigned. Refer to Reassign the Account Manager and Authorized Representative Roles for additional information.

Information That Cannot Be Changed

The following information cannot be changed after submitting an application:

-

Plan Information - It is not possible to change the Plan Year Start/End Dates after they are defined for the application during the Create Application process and submitted to CMS' RDS Center. If the Plan Year Start/End Dates on the submitted application are incorrect, the Plan Sponsor must contact CMS' RDS Center. If the Plan Sponsor needs to shorten the plan year originally submitted with the application, refer to Common Question 7000-7.

Note: The only item of Plan Information that can be changed is the Application Name, and the Account Manager is the only role that is granted permission to do so. For more information on changing the Application Name, refer to Application Submission: Create Application.

- Benefit Option - It is not possible to add or delete Benefit Option(s) once the application has been submitted to CMS' RDS Center. Before and after application submission, the Plan Sponsor may change the Benefit Option Name, Benefit Option Type, and Retiree Submission Method. After the Benefit Option Name is defined, it may be changed at any point in the application lifecycle. The Benefit Option Type may be changed up until costs are reported for the Benefit Option. After costs are reported, the Benefit Option Type cannot be changed.

- To effectively delete a Benefit Option from an approved application, it is necessary to remove the retirees from that Benefit Option. For more information on removing retirees, refer to Managing Retiree Information.

- When determining if it is necessary to ignore a Benefit Option previously defined in the application, remember to consider any impact to the Actuarial Attestation previously provided to CMS' RDS Center for that application. The application still must pass the Actuarial Equivalence Test.

- Assign Actuary - Once the Actuary completes and submits the online Actuarial Equivalence Test and the application is submitted, the Plan Sponsor may not change the Actuary assigned to the application.

- Attestation Summary - Once the Actuary completes and submits the online Actuarial Equivalence Test and the application is submitted, the Actuarial Attestation may not be changed. However, if it is later determined that the plan and/or a Benefit Option do not pass the Actuarial Equivalence Test, the Plan Sponsor must contact CMS' RDS Center.

- Payment Frequency - Payment Frequency is automatically set to the maximum frequency of 12 monthly interim payments for all applications and cannot be changed. Although 12 interim payment requests are permitted, a Plan Sponsor may choose to submit fewer than 12 interim payment requests, or forego interim payments and instead choose to submit one final payment request.

- Plan Sponsor Agreement - Once the Authorized Representative signs and submits the Plan Sponsor Agreement, the Plan Sponsor Agreement may not be withdrawn. If the Organization Name, Account Type, Account Number, or the Bank Routing Number is changed on the Banking Information page, the Authorized Representative must view, re-sign, and re-submit the Plan Sponsor Agreement to CMS' RDS Center. If a new Authorized Representative is assigned to the application, the Plan Sponsor Agreement does not need to be re-signed, as the terms and conditions of the original Plan Sponsor Agreement remain unchanged.

Notifying the Plan Sponsor When Changes Occur

CMS' RDS Center's official means of communication to the Plan Sponsor is through email. CMS' RDS Center notifies the Plan Sponsor by email whenever changes to Plan Sponsor information, Application information, User Account information, or user role assignments occur, or when such changes are required for participation in the RDS program.

In the case of critical data changes such as Qualifying Covered Retirees (QCRs), corresponding Subsidy Periods, and associated Benefit Options, CMS' RDS Center provides a Retiree Response File to the Plan Sponsor whenever a Retiree List is received. CMS' RDS Center also provides a notification file to the Plan Sponsor whenever Medicare notifies CMS' RDS Center of an event that could impact a Plan Sponsor's ability to receive subsidy for a beneficiary. Refer to Retiree Management for additional information.

Manage Retirees Through the Application Lifecycle

Select a topic to learn how to manage Retirees:

- Removing Retirees from a Benefit Option

- Changing Retiree Submission Method

- CMS EFT Connection Setup Times

Retiree information must be continually managed throughout the Application Lifecycle so that the Plan Sponsor's records and CMS' RDS Center's records accurately reflect QCRs, the corresponding Subsidy Periods, and the associated Benefit Options. The Retiree Submission Method may be changed until Reconciliation: Finalize Covered Retirees is complete or the Reconciliation Deadline has passed. The Plan Sponsor can refer to Application Submission: Benefit Options for instructions on how to update or change the Retiree Submission Method within this timeframe.

Removing Retirees from a Benefit Option

A Benefit Option cannot be deleted once the application has been submitted to CMS' RDS Center.

If the Plan Sponsor does not intend to use a Benefit Option defined on an approved application, remove the retirees from that Benefit Option; the Benefit Option itself can stay within the application with no retirees assigned. To remove the retirees associated with the Benefit Option, the Plan Sponsor sends a Monthly Retiree List with Delete (DEL) transactions for only those associated retirees. If necessary, the Plan Sponsor should assign those retirees to other Unique Benefit Option Identifiers (UBOIs) as applicable. For more information on sending retiree files refer to Covered Retiree List.

Changing Retiree Submission Method

Retiree Submission Method may be changed up until Reconciliation: Finalize Covered Retirees is complete or the Reconciliation Deadline has passed. If the Plan Sponsor is changing the Retiree List Submission Method to Connect:Direct, VDSA (Voluntary Data Sharing Agreement), or MIR (Mandatory Insurer Reporting), it is imperative that the Plan Sponsor does not change the Retiree List Submission Method until the appropriate connections to CMS' RDS Center are established and tested.

Changing the Retiree List Submission Method before the new connection is established jeopardizes the Weekly Notification File process. If the Plan Sponsor selects Connect:Direct, VDSA, or MIR as the Weekly Notification File Delivery Method before the connection is successfully established, CMS' RDS Center will be unable to send the Weekly Notification File until the connectivity is established.

The Plan Sponsor should consider the retirees that were submitted prior to the Retiree Submission Method change and ensure that the Qualifying Covered Retirees' (QCRs') information matches the method or Plan Sponsor partner that is now assigned responsibility. The Plan Sponsor should then download the Covered Retiree List (CRL) for verification. Retirees that were submitted from a source that is no longer current should be removed with a Delete transaction and added using the new Retiree List Submission Method or modified with an Update/Add transaction using the new Retiree List Submission Method, in order for the Plan Sponsor or Vendor to properly receive Notification Files.

For information about downloading the CRL, refer to Covered Retiree List.

A Retiree Submission Method may be changed using the same process in which it was initially set. For information about how to change a Retiree Submission Method, refer to Application Submission: Benefit Options.

CMS EFT Connection Setup Times:

- For Plan Sponsors or Vendors with a CMS EFT account and a connection to CMS' RDS Center, the setup takes 1 to 2 weeks.

- For Plan Sponsors or Vendors with a CMS EFT account but no connection to CMS' RDS Center, the setup takes 1 to 2 months.

- For Plan Sponsors or Vendors without a CMS EFT account, the setup takes 2 to 3 months.

- For Plan Sponsors using Coordination of Benefits (COB) with VDSA or MIR, the usual timeframe for completing the agreement and testing with the CMS COB contractor is 60 to 90 days for new agreements.

Manage Banking Information

Select a topic to learn how to manage Banking information.

- Introduction to Managing Banking Information

- Impact to the Application When Banking Information is Changed

- Communication of Banking Information Changes to the Plan Sponsor

- Step-by-Step Instructions to Change Banking Information

Introduction to Managing Banking Information

Banking Information must be maintained on the application for CMS' RDS Center to send subsidy payments to the Plan Sponsor's bank. Banking Information can be changed on submitted applications in any of the following statuses: "Approved," "Application Error," “Reconciliation Cost Reporting Closed,” and "EFT Re-sign Application." In the event that CMS’ RDS Center is unable to render payment due to invalid Banking Information for an application in “Reconciliation Request Completed” status, CMS’ RDS Center will re-open Banking Information on the application and notify the Plan Sponsor to update this information.

The Plan Sponsor may change Banking Information at their discretion, or after CMS' RDS Center sends an email notification of payment or pre-note failure due to invalid or missing banking information. CMS' RDS Center validates certain information including Organization Name, Account Type, Account Number, and Bank Routing Number. If CMS' RDS Center is unable to validate this banking information, the application status changes to "Application Error" and the Plan Sponsor is notified via Warning messages in the RDS Secure Website and email.

Notes:

- If the Organization Name, Account Type, Account Number, or Bank Routing Number is changed, the Authorized Representative must re-sign the Plan Sponsor Agreement. Changing this information impacts CMS' RDS Center's ability to process the Banking Information and may cause the pre-note to fail.

- If information other than the Organization Name, Account Type, Account Number, or Bank Routing Number is changed, the Plan Sponsor Agreement does not need to be re-signed and the terms and conditions of the original Plan Sponsor Agreement remain unchanged.

- If the Reconciliation Deadline for an application is 14 days away or less, Banking Information must be changed in the Reconciliation: Banking Information step.

Some helpful hints when changing Banking Information are:

- Verify with your internal finance department that the bank has not merged or been purchased by another bank. If so, the Bank Routing Number may have changed.

- Verify with your internal finance department that the Bank Routing Number is for ACH (Automated Clearing House), not Wire Transfers.

- The RDS Secure Website supports the following ACH pre-note transactions: “Prenotification for a Checking Account credit” and “Prenotification for a Savings Account credit.” ACH pre-note transactions sent to other account types will fail.

- The RDS Secure Website supports the following ACH payment transactions: “Deposit destined for a Checking Account” and “Deposit destined for a Savings Account.” ACH payment transactions sent to other account types will fail.

- Verify with your internal finance department that the account is active.

Impact to the Application When Banking Information is Changed

Banking Information may be changed on submitted applications in any of the following statuses: "Approved," "Application Error," and "EFT Re-sign Application."

The following three scenarios outline how an application is processed after Banking Information on an application is changed and sent to CMS' RDS Center for processing:

-

Scenario 1: Plan Sponsor changes Organization Name, Account Type, Account Number, or Bank Routing Number

When the Organization Name, Account Type, Account Number, or the Bank Routing Number is changed, the Account Manager must select a checkbox to confirm that they will notify the Authorized Representative that the Plan Sponsor Agreement must be re-signed. The Authorized Representative must view, re-sign, and re-submit the application in order for the Banking validation to be performed. The application status changes to "EFT Re-sign Application" until the Authorized Representative validates this information by recompleting Application Review & Submit. After the application is re-submitted with the new Banking Information, the application status changes to "Submitted" until the revised Banking Information can be verified by CMS' RDS Center.

-

Scenario 2: Plan Sponsor changes Banking Information other than Organization Name, Account Type, Account Number, or Bank Routing Number OR does not change Banking Information while the application is currently in "Approved" status and the EFT section is in "Verified" status

If any information on the Banking Information page other than the Organization Name, Account Type, Account Number, or Bank Routing Number is changed, the information is submitted and does not require the Authorized Representative to re-sign the application. After the Banking Information is saved, the Banking Information status does not change, and the application status changes to "Approved".

-

Scenario 3: Plans Sponsor changes Banking Information other than Organization Name, Account Type, Account Number, or Bank Routing Number OR does not change EFT Information while the application is currently in "Application Error" status and the EFT section is in "Error - Needs Attention" status

This scenario results after the pre-note fails because of a bank processing error. The Plan Sponsor re-enters the Account Number and re-enters the Bank Routing Number on the Banking Information page. The application status changes to "Approved" if the application was previously "Approved" or to "Submitted" if pending approval. The pre-note is generated and sent to the Plan Sponsor's bank for verification.

Communication of Banking Information Changes to the Plan Sponsor

An email confirmation of application changes is sent to the Authorized Representative, Account Manager, and Designee with Complete Banking Information privilege only when Banking Information, including Organization Name, Account Type, Account Number, or Bank Routing Number, is modified.

An email notification regarding Banking Information failures is sent to the Authorized Representative, Account Manager, and Designee with Complete Banking Information privilege.

CMS' RDS Center recommends that the Plan Sponsor notify their bank prior to CMS' RDS Center sending a $0 pre-note for approval.

Step-by-Step Instructions to Change Banking Information

This section provides step-by-step instructions to change Banking Information.

Banking Information may be changed on submitted applications in any of the following statuses: "Approved," "Application Error," “Reconciliation Cost Reporting Closed” and "EFT Re-sign Application." In the event that CMS’ RDS Center is unable to render payment due to invalid Banking Information for an application in “Reconciliation Request Completed” status, CMS’ RDS Center will re-open Banking Information on the application and notify the Plan Sponsor to update this information.

If the Reconciliation Deadline for an application is 14 days away or less, Banking Information must be changed in the Reconciliation: Banking Information step.

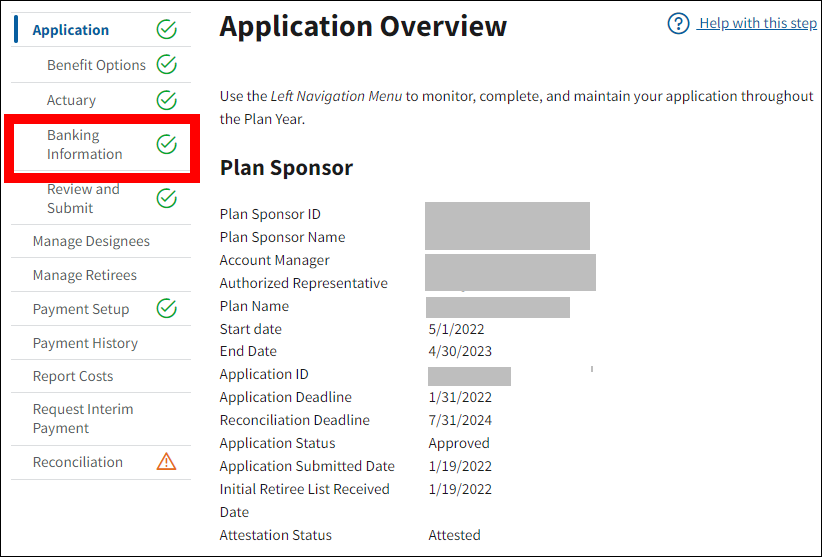

On the Application Overview page:

-

Select Banking Information.

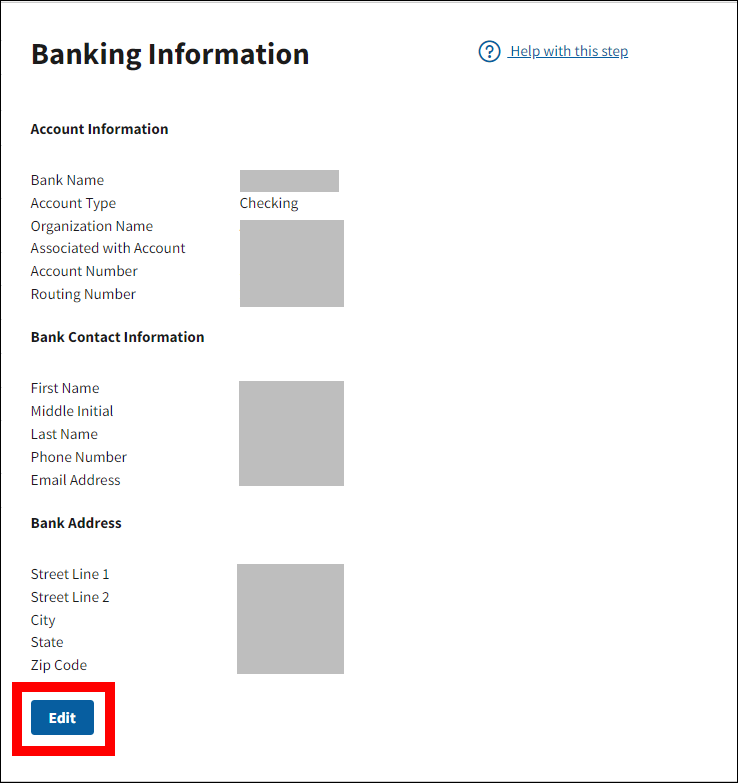

On the Banking Information page:

-

Select Edit to make changes, or select Cancel to return to the Application Overview page.

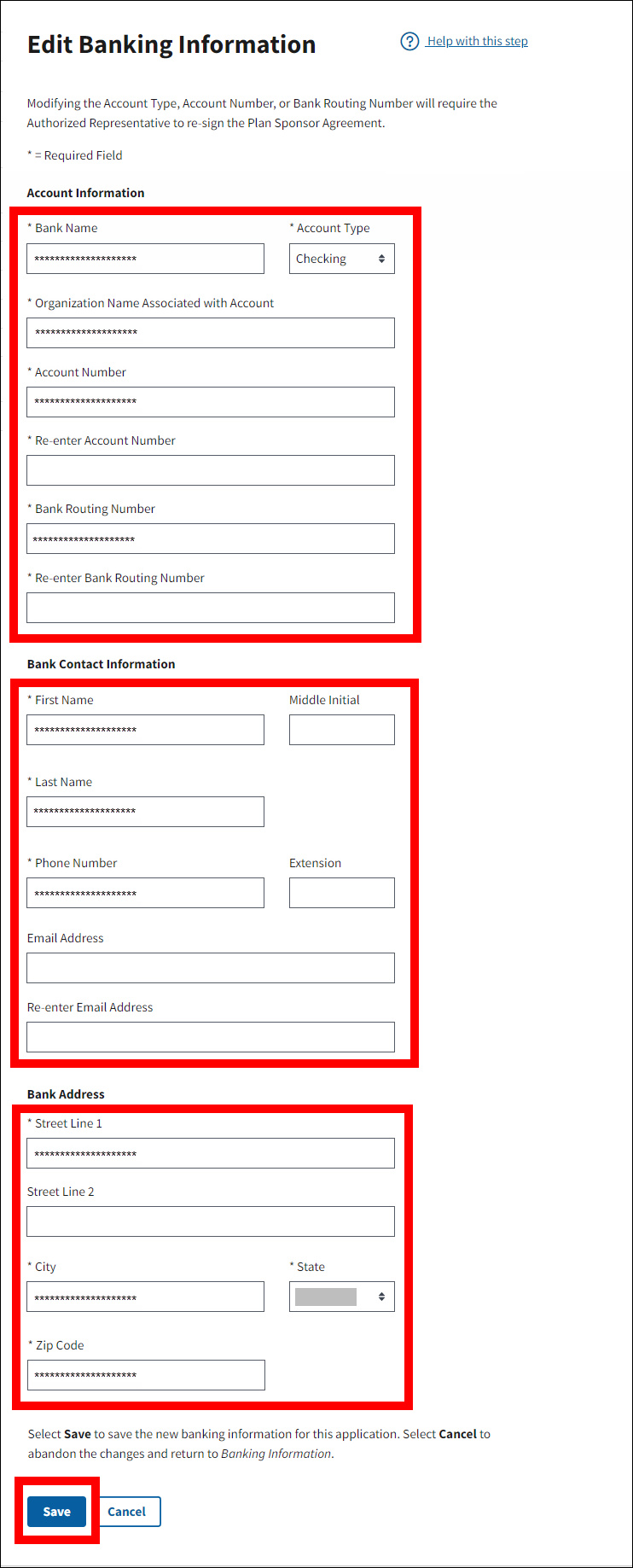

On the Edit Banking Information page:

An asterisk (*) indicates a required field.

- *Enter Bank Name

- *Select Account Type

- *Enter Organization Name Associated with Account

- *Enter Account Number

- *Re-enter Account Number

- *Enter Bank Routing Number

- *Re-enter Bank Routing Number

- *Enter Bank Contact First Name

- *Enter Bank Contact Last Name

- *Enter Bank Contact Phone Number

- *Enter Bank Address Street Line 1

- *Enter Bank Address City

- *Select Bank Address State

- *Enter Bank Address ZIP Code

-

Select Save to update the Banking Information. Select Cancel to return to the Banking Information page without making changes.

Note: Plan Sponsors should verify with their internal finance department that the EFT banking information is correct before submitting the information to CMS' RDS Center. After confirming the Banking Information internally, Plan Sponsors should exercise care when entering the information to ensure prompt verification of the Banking Information and avoid rework on the application.

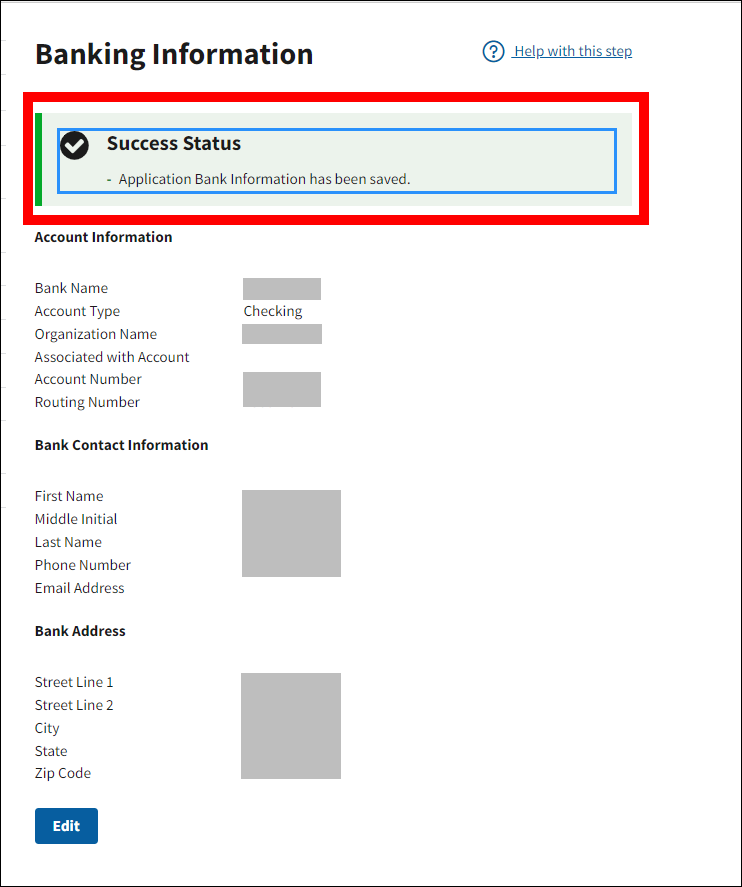

On the Banking Information page:

-

A Success message will display at the top of the Banking Information page and a green check mark will appear next to the Banking Information section in the left navigation menu.