Background

Underreporting Threshold Reduction and Limit Reduction occurs for a couple of reasons: 1) Plan Sponsors do not understand the definition of Threshold Reduction, and 2) Plan Sponsors are not reporting the correct Threshold Reduction and Limit Reduction during interim payments.

Resources Related to This Issue

- Refer to Prepare Cost Data in the RDS User Guide for information on how to report Threshold Reduction and Limit Reduction.

(1) Plan Sponsors do not understand the definition of Threshold Reduction.

CMS' RDS Center has found that some Plan Sponsors misunderstand the meaning of Threshold Reduction. Threshold Reduction is defined as the amount below the federally defined Cost Threshold. The Cost Threshold is a federally defined amount of gross covered retiree plan-related prescription drug costs paid by a qualified retiree prescription drug plan and/or by Qualifying Covered Retirees. The amount up to the Cost Threshold is not eligible for subsidy. CMS' RDS Center has encountered situations where a Plan Sponsor has interpreted the Threshold Reduction as the deductible the retirees pay on their plan or the out-of-pocket amount paid by the retiree. This interpretation has led to incorrect interim payments, and, later, corrections to the data have led to Plan Sponsors being in an overpayment situation at Reconciliation.

Examples

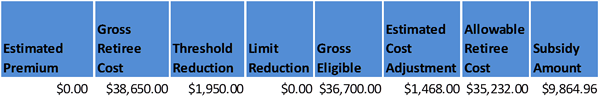

Example 8 illustrates the out-of-pocket amounts being reported on a 2013 application instead of the Threshold Reduction of $325.00. The Benefit Option in this example has 15 retirees, 10 of which have met the threshold. However, instead of the Threshold Reduction being at least equal to $3,250.00, the Plan Sponsor is reporting the out-of-pocket expense incurred by all the retirees in the Threshold Reduction. In Example 8, the wrong amount of $1,950.00 is in the "Threshold Reduction" column. This results in a larger Gross Eligible amount of $36,700.00. The Plan Sponsor receives a Subsidy of $9,864.96.

Example 8: Incorrectly Reporting Out-of-Pocket Retiree Expenses Instead of Threshold Reduction

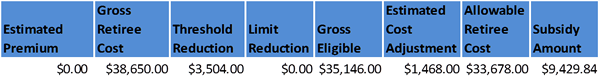

Example 9 displays how the data should be correctly reported. The Threshold Reduction now reflects the correct amount of $3,504.00 instead of the $1,950.00 that was entered in Example 8. The corrected Threshold Reduction reduces the Gross Eligible, Allowable Retiree Cost, and the Subsidy.

Example 9: Correctly Reporting Threshold Reduction

The corrected data has resulted in an overpayment of ($435.12).

(2) Plan Sponsors are not reporting the correct Threshold Reduction and Limit Reduction during interim payments.

CMS changes the threshold and limit amounts from plan year to plan year, and sometimes Plan Sponsors do not update their systems to match the new amounts, or their interpretation of which year Cost Threshold and Cost Limit to use is incorrect. The year in which a Plan Sponsor's RDS plan year ends, as specified in the Plan Sponsor's application, determines the applicable Cost Threshold and Cost Limit amounts for that application.

For example, if a Plan Sponsor's plan year is not based on the traditional calendar year and runs from July 1, 2012 to June 30, 2013, then the Cost Threshold and Cost Limit for 2013 should be used. The same principle applies to plans with traditional calendar years. For detailed information about the Cost Threshold and Cost Limit amounts for specific plan years, refer to Cost Threshold and Cost Limit by Plan Year.

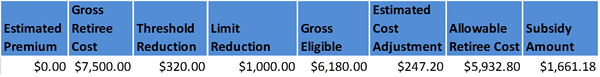

In Example 10, the Plan Sponsor is completing a 2013 application and is reporting costs on this Benefit Option for one retiree. The Plan Sponsor is incorrectly using the 2012 Cost Threshold of $320.00 and Cost Limit of $6,500.00 to calculate the Threshold Reduction and Limit Reduction instead of the 2013 Cost Threshold of $325.00 and Cost Limit of $6,600.00.

Example 10: Application Cost Data Incorrectly Including 2012 Plan Year Cost Threshold and Cost Limit to Calculate the Threshold Reduction and Limit Reduction

In Example 10, the Gross Retiree Cost for the one retiree is being reported correctly at $7,500.00, and the Threshold Reduction of $320.00 and Limit Reduction of $1,000.00 are being reported incorrectly.

Since the incorrect Threshold Reduction and Limit Reduction are being reported in this example, the data is considered irreconcilable. Consequently, no subsidy can be paid for this Benefit Option. In order for subsidy to be paid, the Plan Sponsor would have to cancel the payment request and resubmit a corrected payment request with the Threshold Reduction changed from $320.00 to $325.00. The Limit Reduction was calculated incorrectly using the 2012 Cost Limit of $6,500.00 ($7,500.00 - $6,500.00 = $1,000.00).

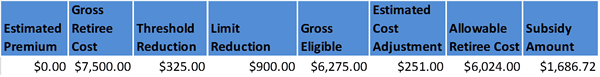

The correct calculation uses the 2013 Cost Limit of $6,600.00 ($7,500.00 - $6,600.00 = $900.00). Example 11 displays cost data that is being reported using the correct 2013 Cost Threshold and Cost Limit. For detailed information about the Cost Threshold and Cost Limit amounts for specific plan years, refer to Cost Threshold and Cost Limit by Plan Year.

Example 11: Application Cost Data Displaying the Correct Cost Threshold and Cost Limit for a 2013 Plan Year

In Example 11, the Gross Retiree Cost for the one retiree is being reported correctly at $7,500.00. The Threshold Reduction of $325.00 is being reported correctly, and the Limit Reduction of $900.00 is being reported correctly.