Handling Coordination of Individual Retiree Cost Data

Plan Sponsors are required to coordinate individual retiree cost data within an application for the purpose of appropriately applying each individual retiree's Cost Threshold and Cost Limit. CMS' RDS Center understands that a situation may arise where individual retirees are associated with more than one Unique Benefit Option Identifier (UBOI) within one of a Plan Sponsor's applications and/or have costs reported by more than one Cost Reporter within the same RDS application. The RDS Program requires Plan Sponsors to coordinate an individual retiree's drug cost data within an application if the retiree is claimed under multiple UBOIs and/or is being claimed by multiple Cost Reporters for the same application. The following scenarios provide examples of when coordination is necessary:

- If multiple Cost Reporters are reporting costs for a single UBOI within the same application

- If any individual retirees are enrolled in more than one UBOI

- If any individual retirees are enrolled in one UBOI within the same application for two or more separate Subsidy Periods

If an individual retiree's drug costs are submitted to CMS' RDS Center for multiple applications, either for the same Plan Sponsor or a different Plan Sponsor, coordination of the retiree cost data across the different applications is not required.

The following examples illustrate how cost data is coordinated for one particular retiree in a UBOI where there is a change in Vendor mid-year.

Example #1:

The Plan Sponsor's plan year is from 1/1/2012 to 12/31/2012. The Cost Threshold for 2012 is $320, and the Cost Limit is $6,500. The Plan Sponsor is submitting payment requests on a quarterly basis. The Plan Sponsor had two Vendors providing claims data during this plan year—Vendor A and Vendor B. The Plan Sponsor terminated their agreement with Vendor A on 6/30/2012. The Plan Sponsor started a new agreement with Vendor B on 7/1/2012.

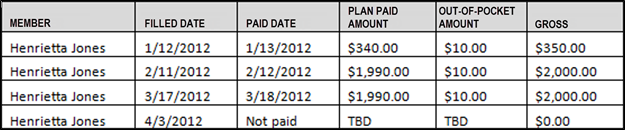

Henrietta Jones is a retiree with claims managed by both Vendors. She is enrolled in a single UBOI. Vendor A submitted aggregated costs on 4/2/2012. These costs were included in payment request #1 submitted to CMS' RDS Center on 4/4/2012. The "Gross Costs" table (Example D-1) displays Ms. Jones' claims history for the months of January 2012 through April 2012.

Example D-1: Vendor A "Gross Costs"

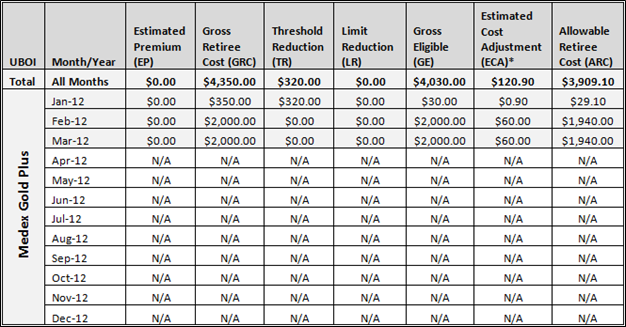

The "Summary Costs Data" example (Example D-2) displays:

Example D-2: Vendor A "Summary Costs Data"

*Estimated Cost Adjustments can only be reported for interim costs. Actual Cost Adjustments must be reported when submitting final costs.

Note: The Estimated Cost Adjustment column displays a percentage of Gross Eligible Costs. In this example, it is assumed a 3% adjustment is being applied. The methodology for calculating Estimated and/or Actual Cost Adjustments may vary in accordance with CMS Retiree Drug Subsidy Guidance: Rebates and Other Price Concessions . The cost of the prescription filled in April was not reported to CMS' RDS Center because the claim was not yet paid.

On 7/5/12, Vendor A submitted aggregated costs for plan months January through June 2012. Aggregated costs for the July and August 2012 plan months were submitted by Vendor B on 8/7/2012. The second payment request submitted on August 9, 2012 included costs reported by both Vendors.The next five examples display Ms. Jones' claims history and resulting cost summaries for the months of January 2012 through August 2012 from both Vendors.

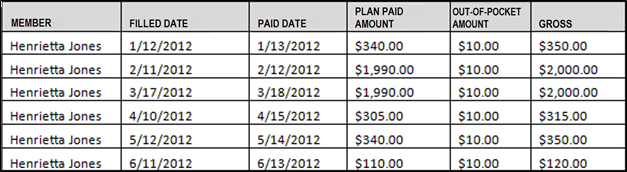

Example D-3 displays Ms. Jones' prescription drug claims managed by Vendor A from January through June 2012.

Example D-3: Vendor A "Gross Costs"

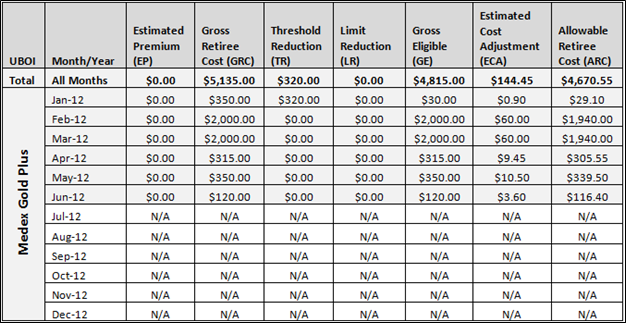

Based on the aforementioned claims in Example D-3, Vendor A would furnish the following summary in Example D-4.

Example D-4: Vendor A "Summary Cost Data"

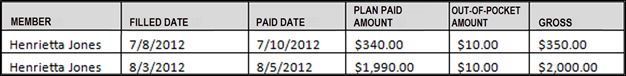

Example D-5 displays Ms. Jones' prescription drug claims managed by Vendor B for July and August 2012.

Example D-5: Vendor B "Gross Costs"

Vendor A (Example D-4) has already satisfied the Threshold Reduction, but if Vendor B does not have Vendor A's cost data, then the Threshold Reduction can be duplicated.

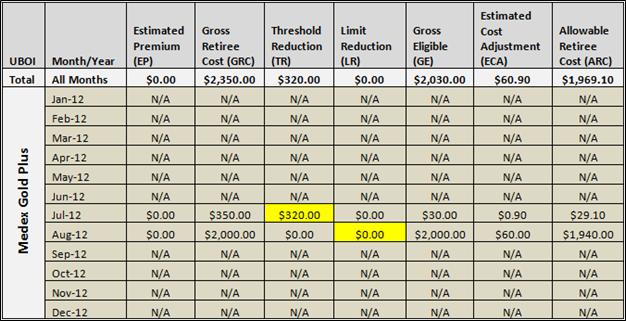

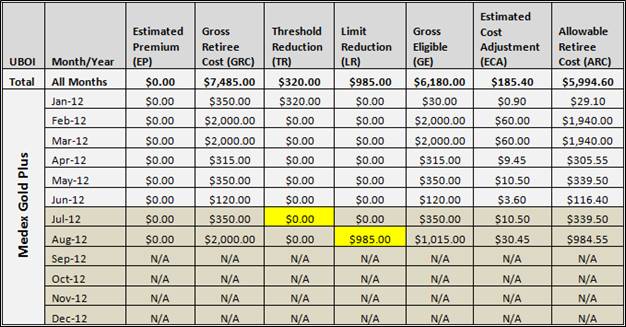

Example D-6 shows summary cost data from Vendor B that has not undergone the required cost coordination with the Vendor A data.

Example D-6: Vendor B "Summary Cost Data"

To resolve this issue, a Cost Reporter needs to aggregate the combined data from both Vendors, or Vendor B needs Vendor A cost data for months 1-6.

Example D-7 shows the corrected summary cost data that should be used to build a payment request.

Example D-7: Vendor A & B "Summary Cost Data"

The Vendor A & B "Summary Cost Data" (Example D-7) reflects the aggregated data. Vendor A satisfied the Threshold Reduction in January; therefore, Vendor B does not need to satisfy it again in July. The July cost data was corrected, and $0 was entered for the Threshold Reduction because more than $320 in Gross Retiree Costs across the application had already been incurred and paid on behalf of Ms. Jones.

Example D-7 also displays a correction in the Limit Reduction field. Vendor A and B individually did not report total costs above the $6,500 Cost Limit for plan year 2012. However, the combined aggregated cost for months 1-8 exceeded the $6,500 Cost Limit by $985.

Example #2:

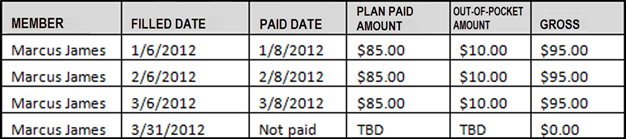

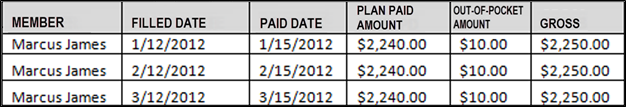

The Plan Sponsor's plan year is from 1/1/2012 to 12/31/2012. The Cost Threshold for 2012 is $320, and the Cost Limit is $6,500. The Plan Sponsor is submitting payment requests on a quarterly basis and is reporting costs by manual data entry through the RDS Secure Website. The Plan Sponsor has one retiree that is covered under two Benefit Options for the same time period. Payment request #1 was submitted to CMS' RDS Center on 4/1/2012. The following "Gross Costs" tables (Examples E-1 and E-2) display Mr. James' claims history for the months of January 2012 through April 2012 for both Benefit Options—Benefit Option RX Regular and Benefit Option-Special CL Retirees.

Example E-1: Benefit Option RX Regular "Gross Costs"

Example E-2: Benefit Option RX Regular "Gross Costs"

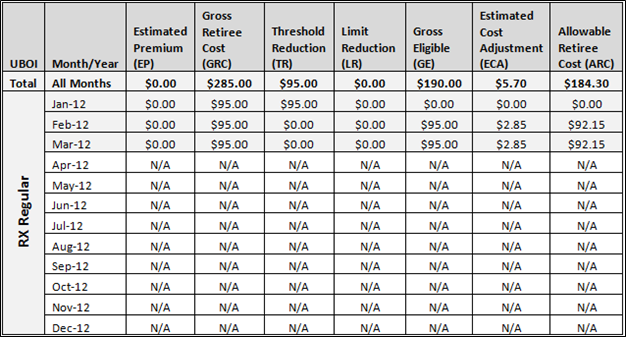

Both Benefit Options have costs incurred in January—the first plan month. For the Summary Cost Data for Benefit Option RX Regular, only the $95 incurred in January contributes to Threshold Reduction. This is because Benefit Option-Special CL Retirees has costs incurred in January that complete the remainder of the Cost Threshold for the retiree.

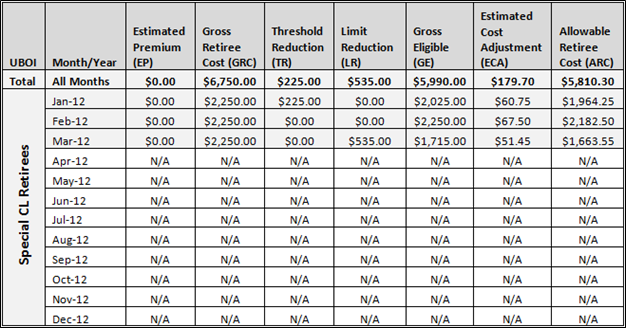

The following Summary Cost Data tables (Examples E-3 and E-4) show the appropriately coordinated summary costs for each Benefit Option.

Example E-3: Benefit Option RX Regular "Summary Cost Data"

Example E-4: Benefit Option-Special CL Retirees "Summary Cost Data"

As shown in Example E-4, only $225 of the January cost for the Special CL Retirees Benefit Option contributes to the Threshold Reduction. This is because the first Benefit Option had $95 in Threshold Reduction contribution from cost that was incurred in January.

The dates costs are incurred within the two Benefit Options also affects the coordinated Limit Reduction amounts. The RX Regular Benefit Option has a total of $285 incurred towards the $6,500 Cost Limit for plan year 2012, while the Special CL Retirees Benefit Option has $6,750. By incurred date sequence, it is the Special CL Retirees Benefit Option's 3/12 claim for $2,250 that causes the total Gross Retiree Cost to exceed the $6,500 Cost Limit. $1,715 of this claim would be counted as Gross Eligible, while $535 would be reported as Limit Reduction.